*This post is part of a series. Start the series from the beginning here.

FREE DOWNLOAD of the Excel File used in this post

As with everything in life, before one can begin, they must start with a foundation, the fundamentals. Saving money is no different. Before we can start saving money and building an emergency fund, we must first know what money/ income is and how it is distributed in and out of the bank account. While this seems to be basic knowledge, there’s much more to it than having your paycheck directly deposited into your bank account and pulling the money when the bills are due.

The first thing to look at when working with your finances is your income or amount of money earned. It is important to note when and how often you receive your income, and approximately what amount of income you expect to receive each paycheck.

With regards to your income, you may hear the terms gross income and net income. Gross income refers to the income you make before any taxes, insurance, 401k, or any other amounts are taken out. This is not the amount of money you should use when creating your budget. Net income however, takes into account all of the pre-tax expenses and is the total amount you will have in your pocket for a given paycheck. Net income is the amount you should use for your budgeting.

The downfall to net income is that you won’t know exactly how much you are going to receive until you actually receive it. Luckily, we can use the gross income to predict how much net income will be received.

The first step to determining your net income is to state out the facts.

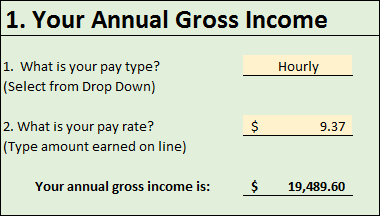

Are you paid per hour, per week, per month, per week? Remember that you may be paid every other week but still be considered hourly.

Let’s determine your gross yearly income. Choose the option below that best suits your pay type:

Hourly: Your hourly Rate * 2080 = yearly gross income.

(52 weeks/year * 40 hours per week = 2080 hours)

Weekly: Your set Rate * 52 weeks = yearly gross income

Bi-weekly: Your set Rate * 26 weeks = yearly gross income

Twice Per month: Your set Rate * 24 = yearly gross income

Monthly: Your set Rate * 12 = yearly gross income

Salary: Your salary = yearly gross income

You are likely either an hourly or salaried employee but are paid bi-weekly. This means that you either have an hourly rate ex. $10/hr and are paid for the time worked during the last two weeks or you have a set amount you are paid yearly but you are paid this amount in smaller equal portions throughout the year.

If you do not have a set pay schedule or a set paycheck amount, a good practice is to take the total pay you claimed on your previous year’s taxes and divide by 12 to see approximately how much you can expect to make each month if you follow the same pattern as the year before.

Of course, there are many other options for how one can get paid. Just choose the option above that best fits your situation to get started.

Now that you know how to determine your gross income, you can estimate your net income. The amount of taxes, 401k, insurance, and other deductions from pre-tax money varies greatly from person to person.

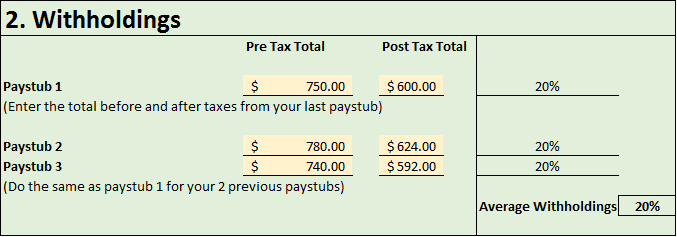

To determine how much is typically taken out of your check, gather your last three pay stubs and do this calculation for each one:

1-(Amount of Check/Gross pre-tax income)

For example: If you made $1500 during your pay cycle but the check after deductions was for $1250, the equation would be:

1-($600/$750) = 1-0.8= 0.2 or 20%

Thus, 20% of your gross pay is deducted for this paycheck. Try the equation with your other two paychecks to see if they have a similar result to the first paycheck.

If they are similar, you are good to go. With my example, I can assume that 20% of my check will be taken out for taxes, 401k, healthcare, etc.

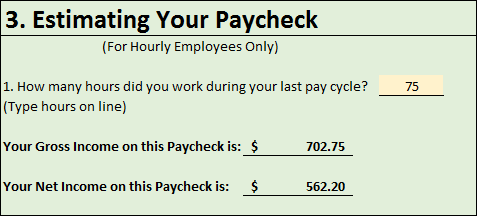

Let’s return to net income. While each paycheck may vary from one another, we can now estimate how much you will get on your next paycheck.

Let’s say you are an hourly employee making $9.37/hour. You worked 40 hours last week but this week you only worked 35 hours. You know that your paycheck will be short but by how much?

Let’s start by determining your gross pay. Using the equation above, we get:

$9.37/hour * (40 hours + 35 hours) = $9.37/hour * (75 hours) = $702.75

To estimate your net income, use your deduction percentage from above. My deduction percentage above was 20%. I can do this one of two ways.

$702.75-($702.72*20%) or $702.75*80%

I typically choose to use the second option. Remember that when multiplying by percentages, you may need to convert to a decimal. 20% = .2 and 80% = .8.

In our example, we have an estimated net income of $562.20. This is the number you should use when beginning any of your budgeting.

Good work! Not everyone is taught this. My dh is in accounting and finance so we’ve taught this to our children in our homeschool. Saving money is what saved us. We had a lot of money saved in the bank when my dh lost his job for almost a year. With that, our real estate investing business and prayer, we were able to make it almost a full year until he got a job.

Fantastic! I am also in the real estate side of things but am not quite there yet. 🙂

Great info! Pinned!

What a great worksheet! Thanks for sharing.

Kari

http://www.sweetteasweetie.com

Coming back when I have more time to really go over this with my numbers. Interested to see how I do.

You can also download the spreadsheet so you can use it whenever you need it. 🙂

Budgets are so important with so many people getting into debt these days. Knowing how to save and what you really need to spend your money on.

Great information! We try not to live paycheck to paycheck but life sometimes gets in the way. We do live within our means and save when possible.

Your annual gross income is so eye opening!

That is amazing! I really need to bookmark this and keep a close eye, it seems it’s so eye opening when I get my end of year W-2.

Love this – keep it up!

xo

Krista

http://www.hundredblog.com

Great post. Thanks for explaining monthly gross and bet so diligently. Most people struggle wth that.

So so so important! This information is really great and Lord, I think so many of we women are deficient in this kind of knowledge. Thank you for sharing!

Great information. I really like how you laid it all out for everyone to understand! It is crazy to see how much money just gets taken off the top. Thanks for sharing!

Thanks for all of this info. I am actually going to send this on to my kids!

Great post! I wasn’t living paycheck to paycheck until I bought my house, now I am back to it. But, it’ll get better as I pay down some debt and build my savings back up.